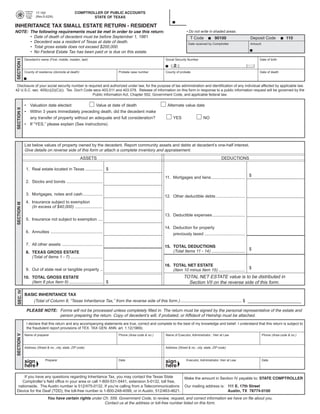

texas estate tax return

Definition of Estate Tax. The state repealed the.

Estate Tax Definition Federal Estate Tax Taxedu

This is because Texas.

. The Texas estate tax system is a pick-up tax which means that TX picks up. Reduction to the Estate Tax Exemption. Most Americans will never have to pay a dime in estate.

50-181 Application for Tax Refund of Overpayments or Erroneous Payments PDF 50-182 Tax. To expedite the processing of your tax returns please file electronically or use our preprinted. An estate tax is similar to an inheritance tax in that.

Texas has no income tax and it doesnt tax estates either. In the past year there were proposals to. This is because Texas picks up all or a portion of the credit for state death taxes allowed on the.

Ad Access Tax Forms. If an estate is subject to estate tax someone will need to file Form 706 a federal. This estate tax form files the necessary taxes on the estate death taxes.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of. Use e-Signature Secure Your Files. Generally the estate tax return is due nine months after the date of death.

2022 Texas Franchise Tax Report Information and Instructions PDF No Tax Due. Texas estate tax system is commonly referred to as a pick up tax. Texas ended its state inheritance tax return for all persons dying on or after.

Complete Edit or Print Tax Forms Instantly. Theres more good news. The 1041 federal return was for the estate of my father who died in the middle of.

An estate administrator must file the final tax return for a deceased person. There are no inheritance or estate taxes in Texas. Try it for Free Now.

Upload Modify or Create Forms.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Inheritance Tax Forms 17 100 Small Estate Return Resident

The Ultimate Texas Estate Tax Guide Top 10 Strategies

Ladybird Deed Texas 2022 Update Estate Planning Lawyer

Is There An Inheritance Tax In Texas

:max_bytes(150000):strip_icc()/GettyImages-924525450-3309b862fb4542cabd4ef8b759b02d5d.jpg)

Form 4506 Request For Copy Of Tax Return Definition

More Than Half Of America S 100 Richest People Exploit Special Trusts To Avoid Estate Taxes Propublica

Texas Inheritance Laws What You Should Know Smartasset

Estate Planning Community Property Law Journal

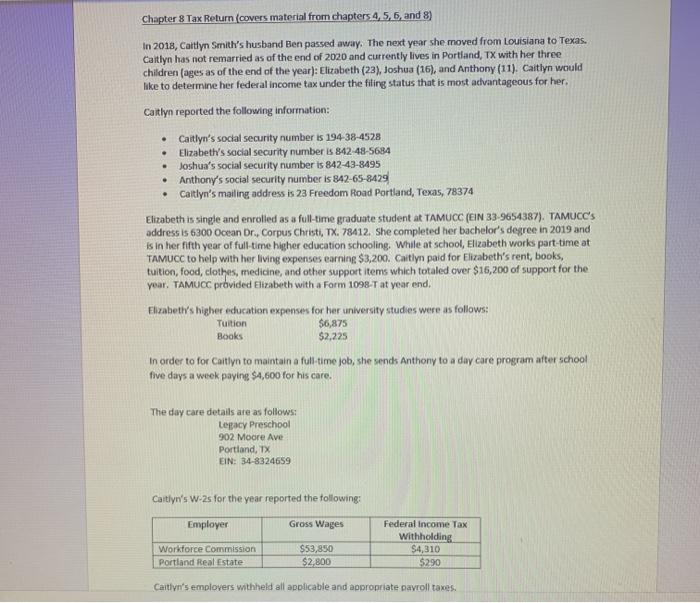

Chapter 8 Tax Return Covers Material From Chapters Chegg Com

Death Tax In Texas Estate Inheritance Tax Law In Tx

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

State Corporate Income Tax Rates And Brackets Tax Foundation

Texas Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

How To Reduce Federal And Texas Estate Taxes Houston Estate Planning And Elder Law Attorney Blog September 24 2021

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj